ASEAN Harmonization: Nutraceutical Product Registration in Southeast Asia (2025)

1. Introduction

Amongst the ASEAN nations [Indonesia, Malaysia, Singapore, Thailand, Vietnam, the Philippines, Brunei, Cambodia, Laos, and Myanmar] the nutraceutical market is growing rapidly driven by increased health awareness, population ageing and consumer demand for preventive healthcare. However, in the ASEAN countries the regulatory frameworks are diverse, which pose significant challenges for product registration and market access. In the ASEAN countries, the regulatory harmonization is crucial for streamlining compliance, enhance consumer safety, and foster cross-border trade within the region. In 2025, several ASEAN countries are co-ordinating to standardize regulatory processes, efficient market entry and regional integration.

2. Understanding the ASEAN Harmonization Framework

The ASEAN TMHS SC [Traditional Medicines and Health Supplements Scientific Committee] plays a central role in developing the scientific and regulatory guidelines for ensuring product safety, quality and efficacy. The scientific committee fronted the development of the ASEAN Guidelines on Health Supplements, which are aimed to harmonize the technical requirements across the ASEAN countries. The key achievements of the scientific committee include the acceptance of common definitions, guiding principles of food additives and excipients, safety evaluation criteria, permitted claims and claims substantiation for traditional medicines and health supplements, and labelling standards. The harmonization of the regulatory frameworks will strengthen consumer protection and market access within Southeast Asia.

3. Key Components of the ASEAN Health Supplement Guidelines

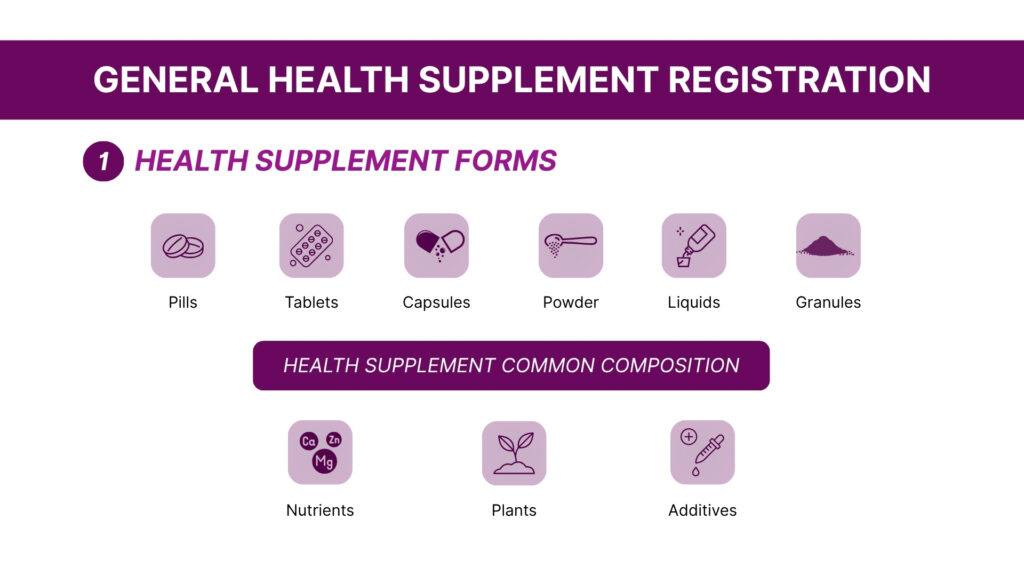

The ‘ASEAN Health Supplement Guidelines’ provided clear definitions and regulatory parameters to distinguish health supplements [products intended to supplement the diet, containing concentrated sources of nutrients], functional foods [conventional food products enhanced with added nutrients or bio actives, consumed as part of a regular diet] and traditional medicines [Products based on traditional knowledge systems (e.g., Ayurveda), often comprising herbal or natural substances used for therapeutic purposes], ensuring consistency across member states.The guidelines classified the health supplement ingredients into four major categories – vitamins, minerals, botanicals [Plant-derived ingredients used for their nutritional or physiological effects] and bio-actives [Compounds with biological activity beyond basic nutrition].Additionally, the guidelines also provide regulations for delivery formats such as solid dosage forms [capsules, tablets, soft gels, lozenges, granules], liquid dosage forms [syrups, oral drops, tonics], powders [sachets or bulk powders for oral consumption]. The standardized categories benefit the regulators and manufacturers in ASEAN countries for aligning product composition, claims, and safety requirements, promoting harmonization and trust across markets.

4. Product Registration Process (Generalized ASEAN Model)

The ASEAN guidelines provided a model for product registration to streamline regulatory procedures across ASEAN countries.

The model aims to reduce duplication, enhance transparency, and facilitate smoother cross-border market entry while ensuring product safety, quality, and efficacy. Pre-market notification is given by manufacturers prior to the launch of low-risk products in countries with lower regulatory barriers. Pre-market approval is required in countries with stringent regulations or higher perceived product risk. A detailed evaluation and approval by the authority is required prior to the launch of the product. The following key documents are generally required for launch of the new product, and they are as follows:

Key Documents Required for New Product Launch (ASEAN Region)

- Ingredient List with Technical Specifications, including:

- Source of each ingredient

- Purity levels

- Concentration used

- Intended use or function of each ingredient

- Stability/Shelf-Life Data of the final product

- Claims and Scientific Justifications

- Clear documentation of health or functional claims

- Scientific evidence supporting pre-approved claims

- All claims must comply with ASEAN-permitted claims list

- GMP Certification

- Good Manufacturing Practice (GMP) certification from the manufacturer is required for regulatory approvals

ASEAN Regulatory Considerations

Some ASEAN countries may recognize product approvals or notifications from other member states

- This may reduce duplication and accelerate market entry

- Note: This reflects a long-term regulatory harmonization goal, not current practice

Individual country authorities retain final regulatory decision-making power

Country-Specific Requirements

Each ASEAN member state may additionally require:

- Country-specific registration or notification fees

- Language-specific labelling and packaging requirements

- Additional safety or toxicological data, if not previously provided

5. Country-wise 2025 Regulatory Updates

5.1. Vietnam

According to the Vietnam Food Administration (VFA) by the Vietnamese Ministry of Health (MoH),

- Labelling Requirements

- Product Identification: The product label must clearly state “Health Supplement”.

- Nutritional Information: Labels must include detailed information on nutritional content such as vitamins, minerals, and other active ingredients.

- Mandatory Disclaimer: The following disclaimer must be printed on the label:

“This product is not a medicine and is not intended to replace medicine.” - Ingredient Disclosure: If the product name includes a key ingredient, the label must specify the exact amount of that ingredient.

- Safety and Hygiene Standards

- Food Safety Certification: All businesses must obtain a Certificate of Compliance with Food Hygiene and Safety Standards.

- Facility Hygiene: Manufacturing, storage, and sales areas must be maintained in a clean and sanitary condition at all times.

- Employee Health and Training:

- Workers involved in supplement handling must undergo regular health check-ups.

- Employees must also receive training in food safety and hygiene practices.

- Product Registration Process

- Self-Declaration: Companies are required to submit a self-declaration dossier to the Ministry of Health (MoH).

- Processing Time: Registration is typically processed within 4 weeks from the date of submission.

- Approval Validity: Once approved, the MoH certificate is permanently valid, with no expiration date.

- Import Documentation Requirements

- Declaration Form: Complete and submit the official import declaration form.

- Food Safety Test Results:

- Provide original, notarized copies of food safety test results.

- Tests must be from a recognized laboratory and conducted within 12 months prior to submission.

- Scientific Evidence: Include research data or studies demonstrating the safety and efficacy of the product or its ingredients.

- GMP Compliance: Submit a valid Good Manufacturing Practice (GMP) certificate or an equivalent document.

Permitted Claims for Health Supplements in Vietnam

- Nutrient Content Claims

- These claims are allowed only if the product contains the stated nutrient.

- The nutrient must be present in an amount that is at least 10% of the Vietnamese Recommended Nutrient Intake (RNI).

- This requirement applies per serving or per 100 grams of the product.

- For claims based on a key ingredient, the product must provide at least 15% of the daily RNI for that ingredient.

- Health Benefit Claims

- Products must contain at least 10% of the RNI of the relevant nutrient to support a health claim.

- All health benefit claims must be backed by credible scientific evidence.

5.1 Singapore – HSA (Health Sciences Authority)

According to the Health Sciences Authority (HSA) of Singapore regulations update pre-market approval are not required for health supplements. The manufacturers remain responsible for product safety and compliance. And the updated guidelines mandate manufacturers to hold valid GMP certifications. Prohibited substances include undeclared active ingredients, human-derived materials, and compounds are listed under the ‘Poisons or Misuse of Drugs Acts’. HSA also actively issues safety alerts on overseas products with harmful ingredients which ensure public health protection.

5.2 Malaysia – NPRA / MOH

The NPRA (National Pharmaceutical Regulatory Agency) of Malaysia implemented significant updates to the regulations detailed in the ‘Drug Registration Guidance Document’. The key updates include comprehensive documentation for product registration along with GMP certification. Moreover, NPRA introduced revised timelines for variation applications [10 – 150 working days], to improve post-approval change efficiency.

5.3 Indonesia – BPOM

In 2025, Indonesia’s National Agency of Drug and Food Control (BPOM) amended criteria for authorized nutrients and modified the permissible limits for certain vitamins and minerals. Also, the revised guidelines mandates stability testing for health supplements, detailing labelling and an intensified post-market surveillance.

5.4 Thailand – FDA – BPOM

The Thai FDA is drafting new legislation to govern the import, export, and transit of health products, aiming to align with current business models and international standards. They revised the guidelines and increased permissible levels for certain vitamins and minerals in health supplements to align with ASEAN standards and an expanded list of 444 approved plant ingredients for dietary supplements with specific limits was released.

6. Permissible Ingredients and Claims (2025 Directory Updates)

The ASEAN guidelines provide a list of ingredients, additives and excipients to be used in the health supplements. Additionally, they have provided a list specifying the limit for list of restricted additives and excipients. A few examples of restricted additives are Allura Red AC [limit: 300 mg/kg]; Fast Green FCF [limit: 600 mg/kg]. The guidelines also provide a safety assessment of additives and excipients for ensuring safety of the ingredients.

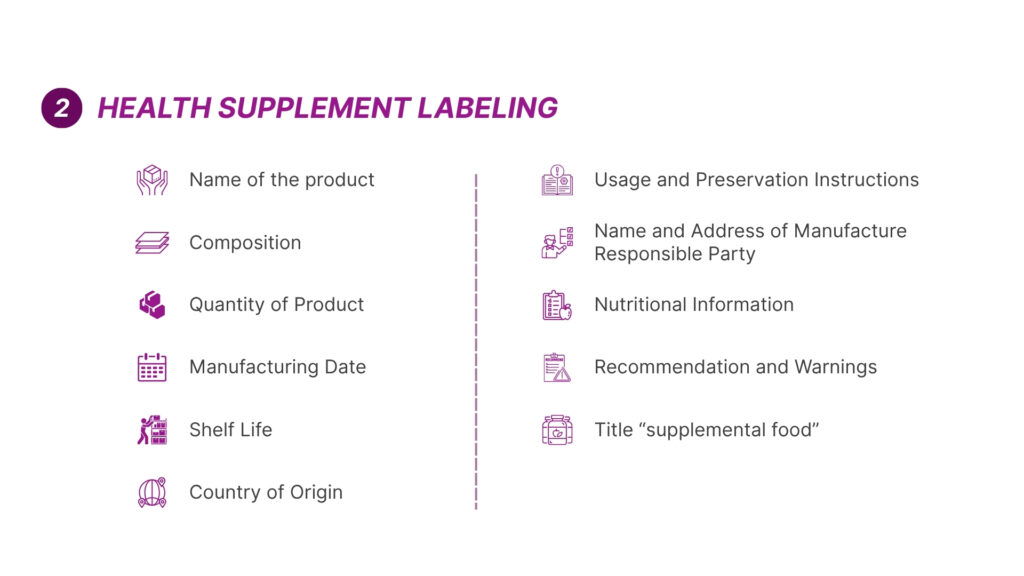

7. Labelling, Packaging & Language Requirements

The labelling requirements include the following components – product name, dosage form, name and strength of active ingredient [e.g.: Each capsule contains herbal extract of XXX mg], batch or lot number, manufacturing and expiry date, or expiry date only, directions of use and indication or intended use, storage condition, country’s registration [listing or notification number], name and address of manufacturer and marketing authorisation holder, pack size and special statements [e.g.; for external uses only].

8. Challenges in Harmonization

The ASEAN member nations have significantly different regulatory process and enforcement capacity. The ASEAN countries follow pre-market approval systems or notifications, causing inconsistencies in timelines and requirements. Though the harmonized guidelines are available, the mutual recognition of approvals are not yet operational. Additionally, member states impose additional national requirements like local labelling rules affecting the harmonization process. Furthermore, the evaluation of novel ingredients might be inconsistent since few ingredients lack ASEAN-wide consensus on safety or efficacy.

9. Opportunities for Market Entry and Expansion

Recently the demand for specific nutraceuticals is rapidly rising and the cross-country commerce for nutraceuticals is rising in the post COVID era. Harmonization of the nutraceutical guidelines will be a significant leap in the expanding the nutraceutical market. Industries can partner with local manufacturing units for ensuring compliance of the nutraceuticals. The harmonization of the ASEAN guidelines will be a gateway for the Asia-Pacific expansion.

10. How Science and Strategic Partner, Guires Food Research Lab Can Help

Strategic partners like Guires Food Research Lab and other scientific organizations are important for accelerating ASEAN market harmonization. Contributions by FRL can bridge regulatory, technical, and industry gaps. FRL can support in clinical research, safety evaluations, and efficacy studies of bio-actives and botanical ingredients for standardizing the scientific basis for claims across ASEAN nations. They can also provide services for regulatory gap analysis, dossier preparation, and ensuring compliance with the ASEAN ingredient list and technical standards. In addition, FRL can facilitate mutual recognition and data-sharing agreements between ASEAN countries.

11. Conclusion

The regulatory harmonization of the nutraceuticals among ASEAN countries will be a transformative step in building a transparent regulatory environment. The ASEAN guidelines can provide regulations for streamlining product approvals, enhance safety standards, and boost cross-border trade. Though few challenges are

recognized, the ongoing collaboration amongst the ASEAN countries provides a clear path. Strategic support from FRLs can accelerate the harmonization. As 2025 emerges as a critical turning point, the harmonized framework can boost the nutraceutical industry.

Let’s create something Innovative and Delicious together

Food Research Lab strives for excellence in new Food, Beverage and Nutraceutical Product Research and Development by offering cutting edge scientific analysis and expertise.