Market Analysis of Nutritious Sugar Free Candy

Consumer awareness of a healthy lifestyle is growing, as is the demand for nutritious meals. People have become more aware of the ideal sugar intake proportion in their daily lives. Low sugar confectionery goods are predicted to be in high demand as a result of these considerations. Furthermore, organic product consumption is steadily expanding. Organic chocolate and confectionery items are recommended by dieticians and health experts. Organic products are in high demand in industrialised countries such as the United States, Germany, the United Kingdom, France, and France. To stimulate product demand, companies like Kraft Foods and Nestle S.A. are creating healthier sweets with a dedication to low fat.

A large number of businesses are currently working on product development and innovation in order to meet rising consumer demand. The advent of unique goods with smell sensations, energy boosts, and a mixture of liquid and solid flavours has been predicted to increase market growth in the next years.

Impact on Confectionary Products

The demand for confectionary items is steadily expanding. Product demand is projected to be driven by consumer preferences for healthy chocolate products and other confectioneries. Sanders & Morley Candy Makers Inc., based in the United States, debuted chocolate covered gummi bears and miniature dark chocolate peppermint patties in January 2017. These campaigns have greatly raised their brand awareness among millennials. Customers who enjoy snacking products with high-quality components, such as peppermint oil, invert sugar, and egg whites, have taken to these products.

Supermarkets, hypermarkets, discounters, convenience stores, grocery stores, and forecourt merchants are among the large and small-scale operators distributing their products through various distribution channels. Confectionery makers are expanding their retail sales channels in cities and small towns as the worldwide population grows. Major chocolate companies such as NESTLE S.A., MONDELEZ INTERNATIONAL, INC., and THE HERSHEY COMPANY have been seen spending heavily in growing their retail chains in Tier 2 and Tier 3 cities in South Asia Pacific countries.

Insights into Market Confectionary

According to a new analysis by Mordor intelligence, the worldwide snack market would increase at a 5.34 percent CAGR from 2020 to 2025 [1]. Snacks have become a vital replacement for meals as a result of our hectic lifestyles. This reflects shifting consumer eating habits as well. The change points to a convenient food opportunity that is exactly proportional to the increase in the snacks market. Different types of snacks and confectionery are segmented in the global snack food industry, with salted snacks, baked snacks, confectionery, and specialty & frozen snacks being the most popular. This year salted snacks are believed to be recording the highest market growth. According to Statista, this industry is currently valued at $100+ billion with an average spend of $300+ per household every year in the US alone.

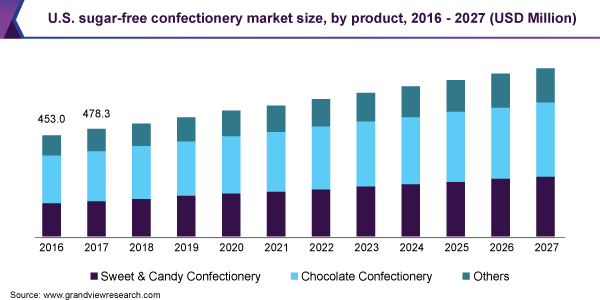

From 2019 to 2024, the confectionery sector is expected to increase at a CAGR of 3.45%, with chocolate being the most popular subcategory. Due to an increasing demand for exotic confectionery items supplied internationally, Asia Pacific and the Middle East are regarded the most promising markets. Consumers are looking for low-calorie, high-cocoa, and functional ingredient-based confectionery for health reasons. Sugar confectionery and snack bars are two other popular divisions of the confectionery industry.

Responding to this difficulty has been more challenging for food makers and formulators in recent years, as customers have become more interested in products made with a restricted number of natural, clean-label ingredients. A partial answer is to replace the bulking, browning, and other qualities that sucrose, glucose, and fructose give in many solid food products with zero-calorie high-potency sweeteners with superior taste performance.

Fig.1. Sugar-free Confectionary Market Size Report (Grand View Research.com)

Current Trends in Food Industry

Increased Preference for Dark Chocolates: According to Euromonitor, dark chocolate sales will surpass ordinary chocolate sales by 3.51 percent next year. Consumers are shifting towards a healthier lifestyle without sacrificing enjoyment, as dark chocolate has health and nutritional benefits. Manufacturers are experimenting with ingredients by substituting sweetened fruits and nuts for sugar. The use of water-in-cocoa butter emulsion, oleogels, hydrogels, polysaccharides, and proteins as partial or complete fat replacers is becoming more popular. Polyols, high potency sweeteners, low/no digestible carbs, sweet proteins, and natural raw materials are used in the industrial creation of sugar-free chocolates.

To make an informed decision about their sweet’s intake, consumers carefully examine the labels and substance.

Plant-Based Revolution: Consumers choose natural, healthful, and eco-friendly products with easily identifiable ingredients. Since last year, snack bars made with healthful plant-based ingredients have been highly known. A unique type of marmalade employing sea buckthorn berries (Hippopha rhamnoides L.) revealed as a possible rich source of bioactive components to be employed in the fabrication of sugar-based products in a recent study published in Journal of Molecules. Sea buckthorn is widely used in nutraceuticals and cosmeceuticals as a valuable source of vitamin C and antioxidants. A unique type of marmalade employing sea buckthorn berries (Hippopha rhamnoides L.) revealed as a possible rich source of bioactive components to be employed in the fabrication of sugar-based products in a recent study published in Journal of Molecules. Sea buckthorn is widely used in nutraceuticals and cosmeceuticals as a valuable source of vitamin C and antioxidants.

Sustainable Choices: Consumers who are prepared to pay more if a company invests in sustainability and an environmentally friendly focus are supporting the push toward sustainability, as are the confectionary and snacking industries. According to the Innova consumer survey 2019, there was a substantial increase from 65 percent to 87 percent from 2018 to 2019. Erythritol is made by fermentation processes, which are typically carried out by fungus or produced by lactic acid bacteria. Yarrowia lipolytica, Moniliella pollinis, and Trichosporonoides megachiliensis have all been reported to be successful for industrial production. Other natural sweeteners with environmentally friendly manufacturing methods are briefly discussed below and are becoming popular culinary components for health-conscious consumers:

• Raw honey is one of nature’s oldest sweeteners. Honey is a sweetener that is sweeter than sugar and is the only sweetener that comes from an animal (insect bees, minilivestock).

• Blackstrap Molasses is a waste product from a raw sugar refinery or a sugarcane mill.

• Real Maple Syrup is created from the sap that is secreted from the stems of the Acer genus in the spring.

• Coconut Sugar is made from the phloem sap of the coconut palm tree (Cocos nucifera L.) blossoms and is produced locally.

• Other combinations: they entail combining several natural sweeteners, such as a low concentration of steviol glycosides (0.5 percent per dry leaf weight) with a little amount of raw organic sugar cane in the production process. Similar to Erysweet+, a stevia erythritol blend, and KetoseSweet+, an allulose, stevia, and monk fruit blend, a combination of sweetening solutions is becoming popular beverages.

Snacks with High Nutritional Value: Consumers are looking for nutrient-dense snacks to make up for their healthy dinners. Prior to making a purchase, they examine the contents, flavours, and calorie content. With snacks, there may be some cultural effect on flavour characteristics depending on the locale. Fructose and glucose are the two most extensively used monosaccharides in the food sector as natural sweeteners. Apart from trehalose and tagatose, there are no novel compounds. They were only recently approved as novel food ingredients or novel foods, and they are now available as sucrose substitutes. Some exotic plants contain naturally produced sweet-tasting proteins. Thaumatin is GRAS-approved in both the EU and the United States. Its energy input is 4 kcal/g, which is minimal in practise because only little amounts are utilised. Brazzein, mabinlin, monelin, miraculin, pentadine, curculin (neoculin), and lysozyme are among the other sweet proteins known, with brazzein, mabinlin, monelin, miraculin, pentadine, curculin (neoculin), and lysozyme being the most promising. However, more research is needed to ensure their safety and applicability.

Sugar-free Options in Confectionery: Sugar-free candy is now widely available, and its popularity among health-conscious consumers is expanding. Sugar-free chewing gums and sugar-free boiled sweets, for example, are already in high demand. They provide a variety of health benefits, including as improved well-being and increased vitality, and there is an increasing need for lozenges to relieve a sore throat.

Snacking by Dietary Guidelines: The food sector is significantly influenced by dietary standards. Dairy products have become a premium snacking option thanks to the popularity of keto diets and a low-carbohydrate lifestyle. These snacks come in different packaging because customers and retailers prefer single-serve choices. Cottage cheese, protein pack assortments, cheese cubes, and sour cream are all examples of dairy snacks that are good for your diet.

Summary

The food sector is still booming, despite the COVID-19 health crisis and recession, with snacking and sweets being a big part of that. Consumers are yearning for comfort food regardless of the economic condition. They are willing to spend extra for snacks that are both healthy and sustainable without sacrificing flavour. Consumers wanting comfort food to have increased month over month. 60 percent of people shopped for confectionary products in May 2020, compared to 56 percent the previous month. Consumers are always seeking for on-the-go snacking options that help them stay energised, thus healthy snacks are all about convenience. It is critical for a company in the food industry to understand and adapt to the needs of its customers.

References

- Misevic, P., Volarevic, H., & Peric, M. (2020, April). THE TREND ANALYSIS OF LESS SUGAR CHOCOLATE CONFECTIONERY MARKETS. In Economic and Social Development (Book of Proceedings), 52nd International Scientific Conference on Economic and Social Development (p. 654).

- Singh, J., Rasane, P., Kaur, S., Kumar, V., Dhawan, K., Mahato, D. K., … & Bhattacharya, J. (2020). Nutritional Interventions and Considerations for the development of low calorie or sugar free foods. Current diabetes reviews, 16(4), 301-312.

- Gómez-Fernández, A. R., Faccinetto-Beltrán, P., Orozco-Sánchez, N. E., Pérez-Carrillo, E., Santacruz, A., & Jacobo-Velázquez, D. A. (2021). Physicochemical properties and sensory acceptability of sugar-free dark chocolate formulations added with probiotics. Revista Mexicana De Ingeniería Química, 20(2), 697-709.

- Selvasekaran, P., & Chidambaram, R. (2021). Advances in formulation for the production of low-fat, fat-free, low-sugar, and sugar-free chocolates: An overview of the past decade. Trends in Food Science & Technology.